In an increasingly interconnected financial world, combatting the proliferation of weapons of mass destruction (WMD) and its financing remains a top priority. Proliferation financing (PF) involves the provision of funds or financial services that support the development or acquisition of nuclear, chemical, or biological weapons, undermining global security and financial stability.

To address these risks, the Cyprus Securities and Exchange Commission (CySEC) has issued comprehensive guidance aimed at regulated entities, outlining essential measures for identifying, assessing, and mitigating PF risks. This guidance, aligned with international standards, provides critical tools for compliance and risk management.

PF risks are often concealed within legitimate trade or financial flows, particularly through dual-use items that can serve both civilian and military purposes. Bad actors exploit gaps in export controls and financial systems, employing complex structures, intermediary companies, and false documentation to obscure their activities. CySEC highlights the heightened exposure of jurisdictions like Cyprus, which serve as international financial hubs, to these sophisticated networks.

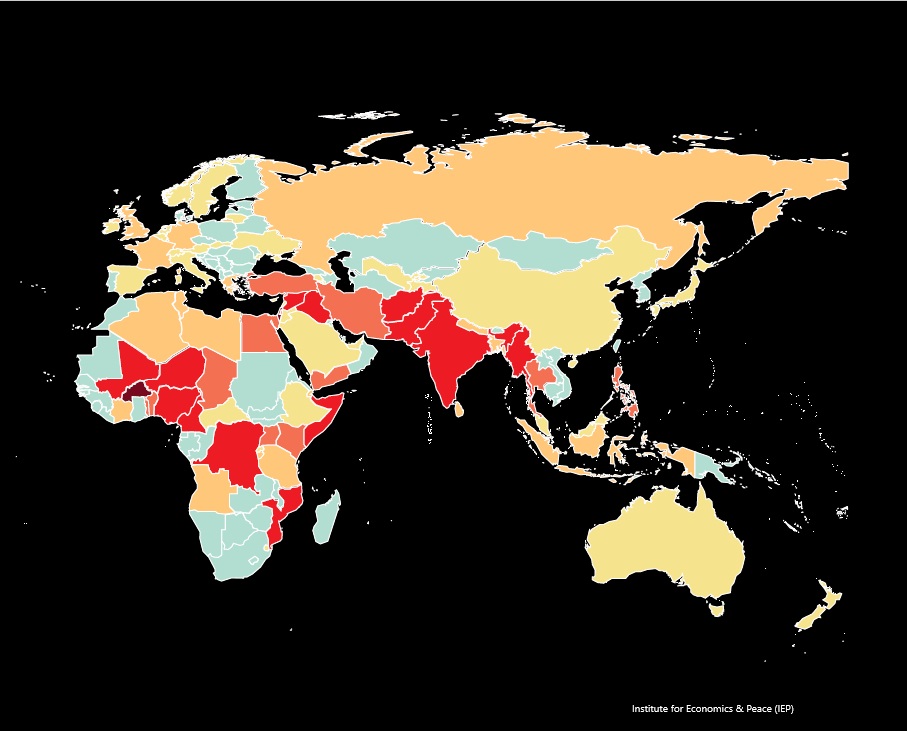

CySEC’s guidance emphasises the unique nature of PF risks, noting that they may not trigger traditional red flags associated with money laundering or terrorism financing. For example, transactions involving dual-use goods or jurisdictions with proximity to high-risk countries, such as North Korea or Iran, warrant closer scrutiny.

The CySEC guidance builds on global frameworks, including UN Security Council Resolutions (UNSCRs), which mandate targeted financial sanctions and export controls to prevent the financing of proliferation activities, the FATF Recommendations, which call for risk-based approaches, inter-agency collaboration, and enhanced monitoring of virtual assets, and EU Restrictive Measures, which require compliance with export controls and sanctions on dual-use goods and proliferation-sensitive items.

CySEC further outlines obligations under Cyprus’s national laws, reinforcing the responsibility of regulated entities to adhere to these frameworks and implement effective controls.

CySEC’s guidance emphasises on the importance of conducting thorough PF risk assessments. This involves threat identification by analysing sectors, products, or transactions vulnerable to exploitation, the vulnerability assessment, by identifying gaps in compliance programmes, export controls, or customer due diligence, and certain red flag indicators, which will lead to monitoring transactions involving dual-use goods, complex corporate structures, or connections to high-risk jurisdictions.

Recommended mitigation strategies include enhanced customer due diligence (EDD), sanctions screening, and leveraging technologies such as blockchain analysis tools to monitor crypto-asset transactions.

CySEC highlights that financial institutions and other regulated entities play a central role in preventing PF. Entities are expected to include PF risk components into broader compliance frameworks, stay updated on sanctions lists and PF-related typologies and engage in continuous staff training to detect and address PF risks effectively.

CySEC’s guidance serves as a cornerstone for regulated entities in the fight against proliferation financing. By implementing the outlined risk-based measures and controls, financial institutions can safeguard their operations and contribute to global security.

Combatting proliferation financing requires vigilance, collaboration, and adherence to regulatory obligations. CySEC’s framework equips businesses with the tools they need to address these challenges proactively.

MK Compliance Limited offers support to help businesses with the complexities of proliferation financing compliance. We provide daily, weekly, or monthly updates on sanctions and AML regulatory developments, including those related to PF, ensuring that you remain informed about the latest regulatory changes.

Our sanctions-related consulting services extend to transaction reviews, sanctions screening, and in-depth background checks on clients, entities, and counterparties to identify and mitigate PF risks. By strengthening your compliance framework, we ensure your business is fully aligned with applicable sanctions and regulatory requirements, reducing the risk of breaches.

For more information, please contact our team at info@compliancemk.com.