The UAE has issued a Federal Decree-Law amending some provisions of the Federal Decree-Law on Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) and Financing of Illegal Organisations. The new Decree is part of the UAE’s efforts to enhance the regulatory and legal framework against Money Laundering (ML) and the Financing of Terrorism (FT).

In this context, the new Decree introduces amendments aimed at strengthening the legal structures that support the UAE authorities in combating ML/TF. It also seeks to enhance the nation’s efforts to adhere to international recommendations and standards.

The amendments introduced by the new Decree include the establishment of the National Committee for Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organisations and the Supreme Committee for the Oversight of the National Strategy for Anti-Money Laundering and Counter-Terrorism Financing. These committees will be formed by a Cabinet decision.

The Supreme Committee for the Oversight of the National Strategy for Anti-Money Laundering and Counter-Terrorism Financing will be responsible for monitoring and evaluating the effectiveness of strategies implemented by the National Committee. It will also be accountable for the introduction of necessary measures and requirements for compliance with AML and CFT. Furthermore, the Supreme Committee will oversee and assess the effectiveness of the measures and strategies implemented by the National Committee for AML and CFT, defining and supervising the implementation of measures and requirements that are to be met by the National Committee and relevant entities.

Additionally, the Decree mandates the establishment of a General Secretariat for the National Committee, headed by a Secretary-General. The Secretary-General shall also serve as the Vice-Chairperson of the National Committee and as a member of the Supreme Committee.

The Decree also includes the development of the Mutual Evaluation Report, which will assess the UAE’s compliance with global AML and CFT standards.

The new Decree reinforces the UAE’s commitment to fighting financial crimes such as ML and TF.

In addition to the Decree, the UAE’s fight against ML and TF recently included the suspension of 32 local gold refineries for three months due to their failure to comply with the country’s AML and CFT laws. These refineries were additionally charged with 256 violations, including failure to implement proper measures for identifying ML risks, failure to report suspicious transactions to the UAE’s Financial Information Unit, and failure to conduct customer and transaction database screenings.

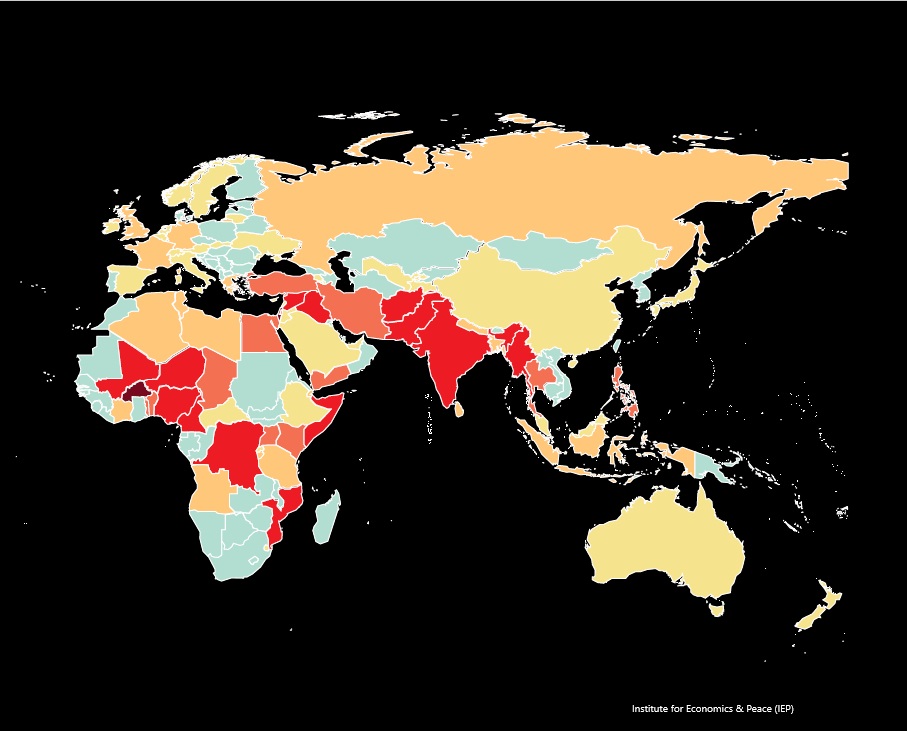

A sign of the progress made in recent years is that the country was removed from the Financial Action Task Force’s grey list this February the UAE’s removal from the grey list signifies its commitment to combatting money laundering and terrorist financing. The UAE had been placed on the grey list in 2022.

The UAE’s recent changes to its AML and CFT laws highlight the country’s strong commitment to fighting financial crimes. By establishing new committees and taking firm action against non-compliant entities, the UAE is reinforcing its efforts to meet international standards. The removal from the FATF grey list is a clear sign of progress, showing that the UAE is serious about maintaining a safe and transparent financial system.

For more information, please contact us at info@compliancemk.com.